In recent years, with the expansion of enterprise scale and intensification of competition, senior management of enterprises have realized the importance of timely feedback on the current operating conditions of enterprises through accounting, and hopes that timely recording and analysis of accounts will force the rationalization and standardization of front-end businesses, and thus achieve the goal of digital transformation and upgrading.

1.All automated and intelligent measures are like external martial arts. No matter how strong the moves are, they can only solve specific problems or improve local benefits. The integration of business and finance is the internal strength to lay the foundation for digital management of enterprises. If the internal strength is not good, it will be difficult to sublimate the overall combat power of the company to a higher level. 2.Through the integration of business and finance, the internal meridians of enterprise operations are cleared, and accounting operations require all business units to promote detailed management and control, so that the business data can be presented in a timely and transparent manner, so that the business physique can be strengthened, the internal problems and external challenges can be quickly understood, and effective response measures should be proposed in a timely manner.

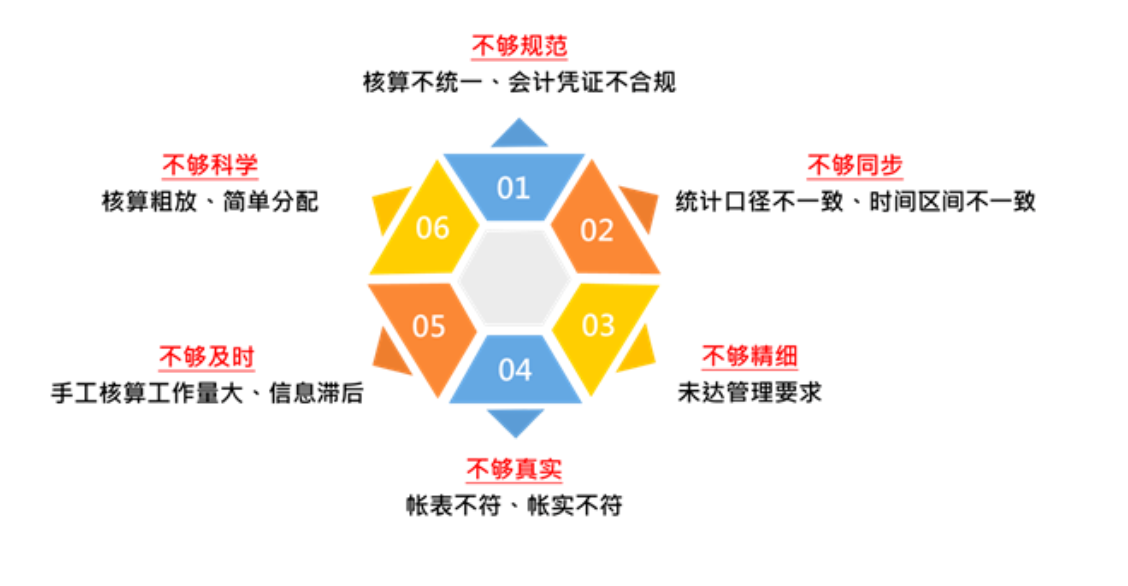

The enterprise's financial integration has not achieved good results, and the following situations are mainly encountered: 1. Data is not scientific:The basic ideas of each front-end business unit may be unrealistic and lack coordination between each other. In the end, the data with the highest commonness can only be used to extensively calculate. 2. The data is not timely:Due to the lack of refinement of business data, inconsistency of processes, and human intervention, the data feedback to the system is delayed, resulting in the failure of the upper-level leaders to obtain business and financial information in a timely manner. 3. The data is not standardized:The front-end business docking content is not standardized, and the business accounting content and accounting methods are not unified, resulting in data being unable to be interrogated. 4. The data is incomplete (real):The front-end business does not collect detailed data, and the undertaking unit cannot conduct detailed analysis, and it is ultimately difficult to conduct reconciliation operations of the general ledger and various detailed ledgers, and it is difficult to ensure the authenticity of the business finance data. 5. Data incoherence (synchronous):Because each unit has different definitions of the same field, the statistical caliber is different, and the statistical period is incorrect, many units spend a lot of time communicating and modifying data across units. 6. The data is not fine:The failure of each business to collaborate and share data and jointly build complete and timely business data, resulting in the fact that each business can only manually count and summarize the information before sending the accounting information.

Due to the interlaced business and complex process of steel enterprises, the difficulties of business and financial integration are more prominent. As for steel companies, the overall goals of business and finance integration should include: 1. Control of the entire production and sales process:In response to the transformation and development of custom orders, after ERP receives orders, it will be distributed to each production line MES through production and sales conversion, collects production performance of each factory, and refines it to the inventory ID for tracking, so as to complete real-time inquiry, order acceptance, and delivery, settlement, shipment and other operations. (Refer to ICSC official account "Discussions and Solutions for the Informationization of Steel Sales Management in Steel Industry"). 2. Cost refined control:Build an information system that takes each production process as the cost center, handles cost changes in various production conditions, and completes cost accounting for different steel grades, further provides customized order-taking benefits calculation and support cost reduction control for each process. (Refer to ICSC official account "Cost Management Solutions for Steel Enterprises in the New Competitive Environment").

How to promote the integration of steel enterprises and finance When steel companies promote the construction of integrated business and finance, they should pay attention to the following order of promotion: 1. Build consensus on goals:Integration of business and finance is a major project for improving the overall business physical fitness of enterprises. Therefore, it is necessary to first advocate the definition, concept and goals of the integration of industry and finance, and establish consensus among the leaders and cadres of the company. 2. Planning management and control indicators and sorting out process structure:The integration of business and finance must first be based on the market positioning, business strategy and management capabilities of the steel company, and plan the main management and control indicators of each business item, refine the management and control caliber, and adjust the necessary organizational responsibilities to complete the business process sorting. 3. Build information system:According to the process sorting results, import or optimize ERP, production and sales integrated platforms, various MES, and cost systems, complete business connection between each system, and implement information system upgrades with integrated production and sales, management and control connection, and three-stream synchronization.

2022-01-27

2022-01-27 ICSC News

ICSC News 上一篇

上一篇